[ad_1]

Tax can be complicated pretty quickly. But it doesn’t have to be if you are using the right tax planning strategies.

It allows you to make better financial and tax decisions by making the most out of your money.

Let’s go over the tax planning definition before looking into the tax strategies.

What Is Tax Planning?

Tax planning can be summarized in one simple sentence.

Make the most out of your financial situation by lowering your taxable income as much as possible.

It doesn’t mean that you have to do shady things to do that.

Think about the IRS as your business partner that you need to pay whenever you make a profit.

The less profit you make, the less you need to share.

A lot of incentives are offered by the IRS for you to pay fewer taxes.

You just have to know them and take action!

11 Year End Tax Planning Strategies To Reduce Your Taxable Income

What Is a Year End Tax Planning Strategy?

First thing first, a year end tax planning strategy is an action that you take to make the most out of your money.

There are three ways it can help you.

- Reducing your taxable income

- Using money that otherwise would be lost

- Avoiding penalty fees

Most of these strategies need to be executed before December 31st.

1 – Determine Your Tax Deduction Category

Standard vs. Itemized

You can take advantage of the standard tax deduction without having to do anything special.

Per the IRS, In 2021, this tax deduction was $12,550 for a single person and $25,100 for a married couple.

The itemized tax deduction is a bit more complicated than the standard deduction.

You have to keep track of many documents and do a few calculations.

The most popular itemized deductions are state and local taxes, home mortgage interests, and charitable contributions.

Just keep in mind that the state and local taxes have a cap of $10,000 per year.

2 – Year End Tax Loss Harvesting Strategy

You can take advantage of the tax-loss harvesting strategy for your losing investments. This strategy allows you to offset your capital gains by selling your losing assets.

For example, if you sell some investments for a $5,000 gain and sell other assets for a $4,000 loss, your capital gains will only be $1,000.

So, instead of paying taxes on $5,000, you will pay taxes on only the $1,000. However, you have to sell your losses before the end of the year to take advantage of this strategy.

If your losses exceed your gains, you can deduct up to $3,000 from your income. However, if it exceeds $3,000, the remaining losses will be passed to the next tax year.

3 – Maximize Your Retirement Contributions

Maximize your retirement contributions in a 401(k) or IRA. It can help you save money for your future and reduce your taxable income immediately.

In 2021, the contribution limit for 401(k) plans was $19,500 and $6,000 for IRAs.

So if you haven’t reached the limit yet, increase your contributions for the rest of the year.

4 – Contribute To Your FSA

If you contributed to your FSA (Flexible Spending Account) all year long, now is a great time to assess what you can do.

FSAs allow you to carry over up to $500 to the following year.

So, if your remaining balance is higher than $500, it is time to catch up on your medical visits. Because you will lose this money if you don’t.

For example, you could make a primary care appointment, get physical therapy sessions, or call your dentist and optometrist until your account shows a below or a $500 balance.

5 – Do Not Forget About Retirement Account Minimum Distributions

Take a moment to log into your retirement account and check how much your yearly required minimum distributions are.

It is your last chance to avoid paying a 50% penalty, so it is time to transfer the money to your bank account.

This penalty applies to you if you inherited a retirement account or are more than 70.5.

6 – End Of Year Tax Assets Protection

It is essential to have a plan for different life scenarios, even if we know how hard it is to think about them. However, it will allow you and your family to avoid making financial mistakes.

First, make sure your beneficiary designations to be up to date on all your financial accounts. If they are not, the court will follow your state laws to determine the allocation of your financial assets.

Another thing you can do is to have a financial plan in case something happens to any of your family members. Talk to your attorney to know about all the possibilities available in your state.

7– Year End Tax Protection With IRS PIN

Identity theft is common during tax season, and it is the last thing you want to have in mind when filing your taxes.

The most common tax fraud is for someone to file your taxes on your behalf and collect your tax refund.

However, the IRS created a system to protect you against identity theft. In January, you can go to the IRS website and apply for a PIN (Personal Identification Number).

Each year, the IRS will send you a unique PIN. You will have to file your taxes using this PIN because that is the only way they will accept your tax return forms. As of 2019, this service is only available in 19 states.

If someone files the tax return forms on your behalf without including the PIN, the IRS will automatically reject it.

8 – Determine Your Tax Payments

This year end tax tip is significant because it can help you avoid the underpayment of the estimated tax penalty.

This penalty will apply to your situation if you pay fewer taxes than what you owe to the IRS.

The good news is that you can determine if you have been paying sufficient taxes throughout the year by using the IRS Withholding Estimator.

If you didn’t pay enough taxes, you can adjust the amount of taxes that the IRS is withholding from your year-end paycheck via your W-4.

9 – Know When To File Your Taxes

In 2022, the tax season opened in the last week of January and closed on April 15th.

However, filing your taxes as soon as possible is a better option if you get a tax refund.

Think about your tax refund as a free loan that you are giving to the government. So, the sooner you can get it, the sooner you can pay down your debt, increase your savings, or invest it to make more out of it.

10 – Deadline For Your Tax Contributions

December 31st is the deadline for all your 2021 contributions. If you miss this deadline, you will have to wait another year to benefit from their tax advantages.

However, there is an exception for HSAs and retirement accounts such as Roth or Traditional IRAs.

You can make non-payroll contributions until April 15th.

11 – Accelerate Your Business Payments

If you own a business, you might want to accelerate your business payments if you had a significant year in terms of revenue.

This strategy consists of paying your expenses for next year before Dec. 31st.

In this case, you can take advantage of the tax deductions immediately instead of waiting another 12 months.

So, pay for your rent or buy those big purchases before Dec. 31st to take advantage of those tax deductions.

Tax Planning – Standard Deduction vs Itemized Deduction?.

I know filing your taxes is not the most entertaining thing to do.

However, understanding how it works is necessary.

That way, you can be sure that you are making the right financial decision.

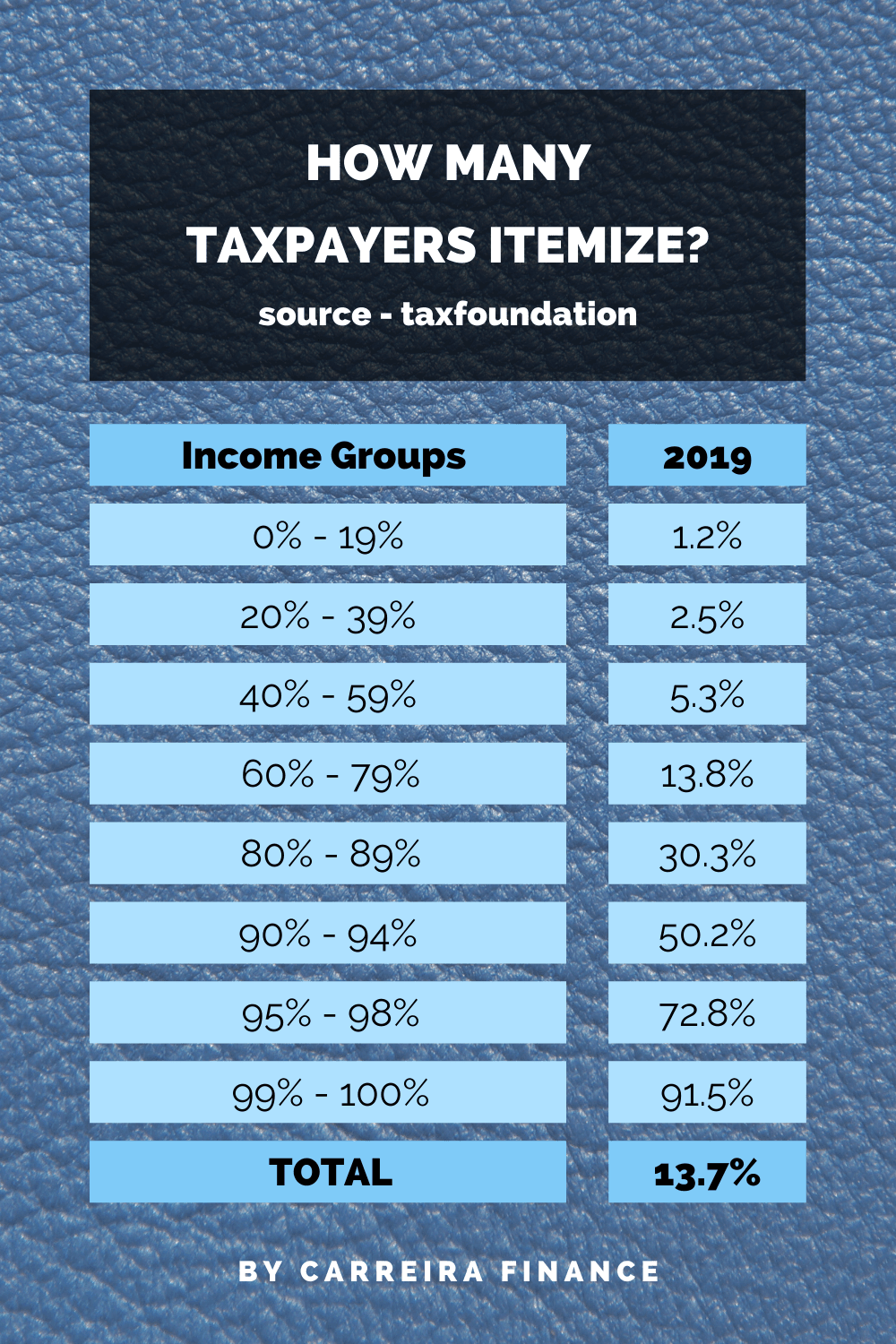

According to Taxfoundation, only 13.7% of taxpayers chose the itemized deduction for 2021.

But what is the best tax planning deduction for your financial situation?

What Is Standard Deduction?

The standard deduction is easier to manage and understand than the itemized deduction.

It is a fixed dollar amount that you can deduct from your taxable income. No matter how much you make or give. The deductible amount is the same for everyone with the same filed tax status.

In 2021, the standard deduction:

- $12,550 for single or married filing separately

- $25,100 for married filing jointly

- $18,800 for the head of household

If you file as married filing separately and claim the standard deduction, your spouse will have to claim the same tax deduction.

You can’t claim the standard write-off if your spouse chooses the itemized deduction.

There are additional deductions you can get if you:

- Are legally blind

- Have been a victim of a disaster-related casualty loss

- Are 65 or older on Dec. 31st of the current tax year or Jan. 1st of the following tax year

You can claim $1,650 for each deduction if single or head of household. Similarly, you can claim $1,300 for each write-off if married, widow, or widower.

What Are Standard Deduction Advantages And Disadvantages?

The best standard tax deduction advantage is that you can claim it no matter your tax or financial situation.

There are no questions asked, and no proof is needed.

Another advantage is that you save a lot of time filling your tax return compared to the itemized deduction.

However, the biggest con is that your deduction is fixed, so your write-off has a limit.

What Is Itemized Deduction?

The itemized deduction helps you lower your taxes because you can deduct specific expenses from your taxable income.

Those expenses need to be allowed by the IRS. So you have to pick and choose which ones to use depending on your situation.

The most popular itemized deduction are:

- Charitable contributions

- State and local taxes (capped at $10,000)

- Real estate property taxes

- Home mortgage interests

- Medical and dental expenses (above 7.5% of your income)

What Are Itemized Deduction Advantages And Disadvantages?

You can deduct more expenses from your taxable income with the itemized deduction compared to the standard one.

For example, you can write off out-of-pocket medical or dental expenses.

It is worth looking into all the deductible expenses allowed by the IRS to find out which ones you would have missed.

Even if your itemized deduction is lower than the standard deduction, you might end up paying fewer taxes by itemizing.

As a result, you might want to try both deductions to know which one is more advantageous in your situation.

But there are also disadvantages if you claim the itemized deduction.

You will need to keep track of your expense receipts.

If you get audited, you will have to show those receipts to verify your deductions.

Each itemized deduction has rules that you have to follow.

So before itemizing, do your research to make sure you are eligible for the deduction.

For example, the state and local tax deductions are capped at $10,000.

Another con is that it takes more time to file your tax return in comparison with the standard deduction.

Also, be aware that certain itemized deductions can increase your chance of an IRS audit.

How To Decide Between The Two Tax Planning Deductions?

As a rule of thumb, if the itemized deduction is higher than what you can get from the standard deduction, you should go with itemized deductions and vice versa.

If you are not sure what the best for your situation is, try both deductions to see which one reduces the most of your taxable income.

Tax laws are regularly changing. Even if you chose the itemized deduction in the past, it might not be the best option for your situation today.

For example, between 2017 and 2018, the standard deduction went from $6,350 to $12,000.

So make sure to do your tax planning each year and calculate your itemized deductions to make the right decision.

If the sum is greater than the standard deduction, it is the best solution and vice-versa.

For example, if you are single, rent an apartment, and you don’t make considerable charitable contributions.

In this case, you will most likely choose the standard deduction unless you max out the state and local taxes and you have more than $2,200 in extra deductions.

If, after doing the maths, you find out that both deductions give similar results, why not make a charitable contribution.

You might not get a big tax cut from it, but at least you will give back to your community and help people in need.

Best Tax Planning Tips To Be Audit Ready

A tax audit is no fun, but there are a few things you can do to be ready in case the IRS gets back to you.

What To Do With Your Tax Documents?

The most well-known tax planning tip is to keep your tax documents for at least 3 years.

If you claim a loss, keep your tax documents for 7 years.

I recommend that you print your tax documents and keep them in the same folder.

That way, you know exactly where they are if you need them.

The other two places you should keep your tax documents are on your laptop and on the cloud.

Tax Planning Tip For Itemized Deduction

If you choose the itemized tax deduction, you have to keep every expense receipt you claimed in case of an audit.

Keep your physical receipts and take a picture of them to upload them to the cloud.

The last thing you want is to go to the audit without proof that your itemized tax deductions are legit.

Tax Planning Services

Tax planning takes time and patience to prepare.

If your tax situation is not too complicated, you can use free tax planning software.

However, if you don’t feel comfortable doing your tax planning on your own, reach out to CPAs as they are the expert in that domain.

Thoughts On Tax Planning

Learning how to reduce your taxable income is crucial as you can save a lot of money.

If you don’t want to spend time figuring out which tax deduction to claim, you should take the standard deduction.

Choosing the standard tax write-off is the simplest and quickest option.

If you have other tax planning ideas that you would like to see in this article, let us know!

[ad_2]

Comments are closed.